Strangle (options)

In finance, a strangle is an investment strategy involving the purchase or sale of particular option derivatives that allows the holder to profit based on how much the price of the underlying security moves, with relatively minimal exposure to the direction of price movement. The purchase of particular option derivatives is known as a long strangle, while the sale of the option derivatives is known as a short strangle. It is related to a similar option strategy known as a straddle. If a big move is expected in the underlying but the direction is not surely known (like when a company is announcing result, or a federal bank is making some policy announcement), straddle and strangle are two options strategies that can be used in such a case. Both strategies consist of buying an equal number of call and put options with the same expiry date.[1]

Contents |

Long strangle

The long strangle involves going long (buying) both a call option and a put option of the same underlying security. Like a long straddle, the options expire at the same time, but unlike a straddle, the options have different strike prices. The owner of a long strangle makes a profit if the underlying price moves far enough away from the current price, either above or below. Thus, an investor may take a long strangle position if he thinks the underlying security is highly volatile, but does not know which direction it is going to move. This position is a limited risk, since the most a purchaser may lose is the cost of both options. At the same time, there is unlimited profit potential.[2]

Strangle Premium

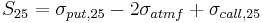

In FX options trading people sometimes talk about the strangle premium. It indicates how much above the at-the-money vol the two out-of-the-money strangle vols are. The strangle premium is a measure of the curvature of the volatility smile. Mathematically, for a given maturity, the 25 strangle premium is:

where  is the vol of the put with the strike chosen to give a delta of -25%.

is the vol of the put with the strike chosen to give a delta of -25%.

is the vol of the call with the strike chosen to give a delta of 25%.

is the vol of the call with the strike chosen to give a delta of 25%.

and  is the vol of call with strike set to the forward.

is the vol of call with strike set to the forward.

Another important thing to keep in mind that when a big move is expected in any underlying, market usually price the option higher. So Premium increases in such case which can affect your payout.[3]

References

- ^ http://nseoptionstrader.blogspot.com

- ^ Barrie, Scott (2001). The Complete Idiot's Guide to Options and Futures. Alpha Books. pp. 120–121. ISBN 0028641388.

- ^ http://nseoptionstrader.blogspot.com

External links

- Long and Short Strangles Illustrates component options in long and short strangles.

|

|||||||||||||||||||||||||||||||||||||